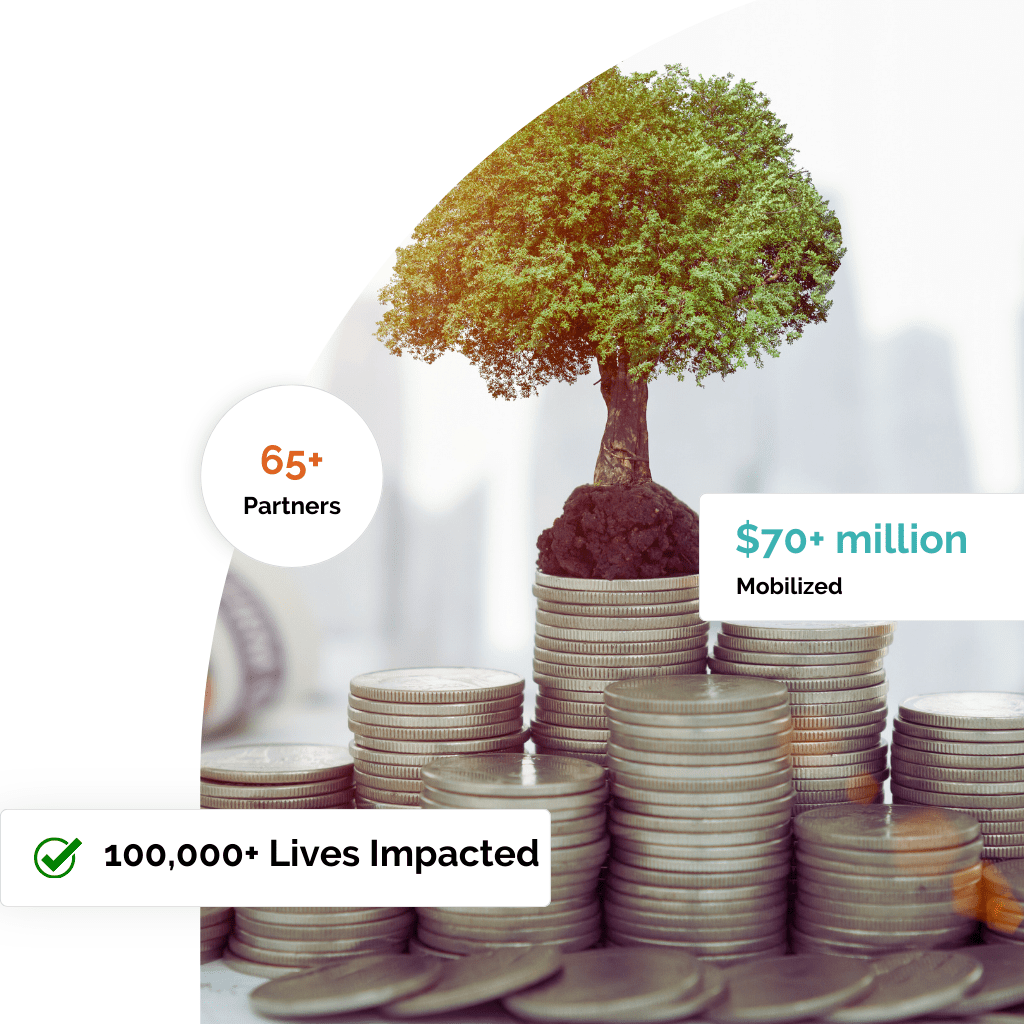

Remove the barriers to impact, spark positive change.

You are motivated to invest in impact-centric programs and funds. We are a connector who helps to unlock funding and move it quickly to those who need it most and are on the ground creating daily impact in their communities.

Together, we can accelerate investments and unlock access to capital that will spark positive change in our communities.

What We Do

Unlock Capital. Remove Barriers. Advance Communities. Catalyze Impact.

We combine our experience in finance and philanthropy to serve as a vehicle and a connector for impact.

We bring new solutions to persistent problems

Many of the biggest problems that persist in our communities have already been hit over the head with conventional thinking and legacy approaches time and time again—and they’re still here. The problems don’t seem to be going anywhere, either, and our communities need resources now.

From Direct Cash Assistance, to Donor-Advised funds, we have many tools in our back pocket. We work with our partners to align the approach with the most effective tool for your impact goals.

How We Do It

Catalyzing Change Through Impact Capital Can Look Like

Direct

Investments

Impact-first investments that go directly to the individual or organization.

Special Purpose

Investment Funds

These funds provide integrated capital in the form of grants and investments focused on a specific area of impact.

Direct Cash

Assistance

Put cash directly into the hands of those who need it to empower impact.

Custom Program

Design

Partner with us to create something new.

Empower Impact with Economic Mobility Programs

There is a growing body of evidence that suggests one of the most effective ways to support people in moving toward economic security is to provide direct cash. The fundamental philosophy behind cash transfers is a belief that people should be trusted to make decisions for themselves.

Unrestricted, cash payments that do not make specific requirements of people to participate give people power and agency over their futures. They can invest in the things that will help them the most.

Basic Cash Assistance for Households program

As a part of Denver’s ongoing efforts to mitigate the negative financial impact of the pandemic throughout the city, The Agency for Human Rights & Community Partnerships’ Denver Office of Immigrant & Refugee Affairs (DOIRA) has established a project for Denver families aimed at reducing the financial instability caused by the COVID-19 pandemic and its aftermath, improving financial security, and supporting families in meeting basic needs required to thrive.

Meet Some of Our Impact Project Partners

Get Started

We combine our experience in finance and philanthropy to deliver more impact in our communities.

Legacy solutions and approaches are no longer the only option. We take creative approaches to catalyze the cycle of impact.

Did You Know?

An Impact Charitable philanthropic capital is the conduit for many different types of impact, made through many different types of tools.

Low-interest loans

Equity investments

Revenue based financing

Pay for success investments

Special purpose investment funds

More Tools, More Creativity

Partner with us to create something new

We are experts in creative financial solutions for greater impact. Because we’re a small team, we move quickly, think flexibly, and don’t let logistical roadblocks get in the way.

Partner with us to become a catalyst and change maker for the causes you care most about. We also support philanthropic advisors in realizing their client’s goals.

Specialized Grant Making

Whether launching a programmatic initiative, joining a funder collaborative or just trying a new philanthropic approach for the first time, it’s helpful to have a strategic partner to turn to—that’s where we come in.

We collectivize our knowledge and strategies and believe that aligned, catalytic grants can have a substantive impact on communities and the environment.

For Greater Impact

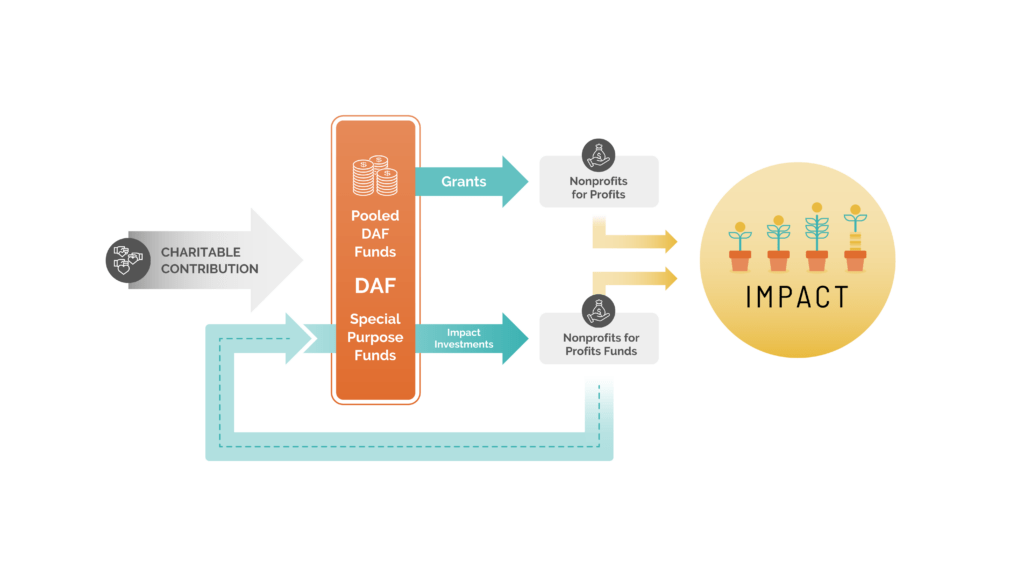

We Recirculate Capital to Repeat the Cycle of Impact

An Impact Charitable Donor-Advised Fund is the conduit for many different types of impact, made through many different types of tools.

Your funds are invested to generate positive social outcomes and financial return. You can then reinvest the same funds to achieve more positive change. Over and over and over again.

Subscribe to Our Newsletter

Be the first to get our exclusive offers, latest news, updates, and events.

It’s a virtuous circle."

Got Questions? We Have Answers

Frequently Asked Questions

A donor-advised fund (DAF) is like a charitable bank account. Once you’ve opened a DAF, you can contribute to it as frequently as you’d like, receiving a tax benefit each time. As the donor-advisor to your fund, you can recommend grants or investments to your favorite charitable organizations or social enterprises.

DAFs are often used for grantmaking, but there’s so much more you can do with this tool! At Impact Charitable, we leverage DAFs in uniquely high-impact ways—like low-interest loans, equity investments, and pay for success investments. We specialize in impact-first investing because this approach allows for capital to be reinvested over and over again.

To get started, fill out our online form. A team member will reach out to you to complete the process and welcome you to the community.

If you know what you’d like to do with your DAF, that’s great. If not—or if you’d like to hear about some creative ways our DAF holders are using this philanthropic tool—James would be happy to walk you through your options.

We view philanthropy as one of the best places to take risks. Why? Because philanthropic capital is unique. Once it’s granted, it no longer belongs to the donor, and the donor knows that they’ll never see those funds again.

Without the expectation of return, philanthropic funds are far more flexible than business or government ever could be—allowing them to be applied to more innovative and higher-risk strategies.

At Impact Charitable, we are all about impact first. That’s why we like to call our strategy not just “impact investing” but “impact-first investing.”

This approach is centered on impact above all—ensuring that every dollar is leveraged for the highest-impact change, whether that’s providing low-cost startup capital to BIPOC-owned businesses or creating the infrastructure for large-scale direct cash transfers.

Learn more by viewing our portfolio or the spectrum of capital in which we work.

No, we are based in Colorado but can make grants across the United States and even internationally. Check out our work to see some examples, or contact us directly for more information.

Impact Charitable’s fees are competitive for boutique impact investing but are certainly higher than big-box DAF providers like Schwab or Fidelity. Our DAF holders come to us because we offer far more unique opportunities for impact, not because we have the lowest fees in town. Contact us to explore your impact opportunities and discuss cost in more detail.

Our minimum to open a DAF is $5,000 (or the expectation to get there). We do not have a minimum for grantmaking.

Possibly. We do connect nonprofits and social enterprises with loans, grants, and direct investments, but we most often work with established community partners to identify and vet recipients. We do not have any kind of direct application for funding.

Still, you’re welcome to reach out to us at info@impactcharitable.org and see if we can help.